Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

05/28/2024

MAIN HIGHLIGHTS:

Global trade is grappling with a significant shortage in ocean container capacity, coinciding with the commencement of peak shipping season. Freight spot rates have surged approximately 30% in recent weeks and are anticipated to continue rising.

Challenges such as adverse weather conditions, prolonged ocean transits, and vessels bypassing ports are exacerbating supply chain disruptions.

Xeneta, a freight intelligence firm, warns that rates may escalate further throughout June, surpassing the notable spike seen in the Red Sea region. Ultimately, these substantial increases are expected to impact consumer prices.

A convergence of forces in global trade has resulted in a major reduction in shipping container capacity, resulting in an abrupt and unexpected increase in ocean freight rates.

The start of peak shipping season, along with extended transits around the Red Sea and severe weather conditions in Asia, has impeded the flow of trade along important routes. Ocean carriers are either bypassing ports or limiting their time at ports, as well as failing to retrieve empty containers, all in an effort to keep vessel deliveries on schedule.

These supply chain difficulties arise at a critical moment, as consumer items destined for the back-to-school and holiday seasons prepare to cross the oceans.

Emily Stausbøll, a senior shipping analyst at Xeneta, adds, "From the Far East to the U.S. West Coast, spot rates are likely to exceed the levels observed during the peak of the Red Sea crisis earlier this year, underscoring the magnitude of recent rate hikes."

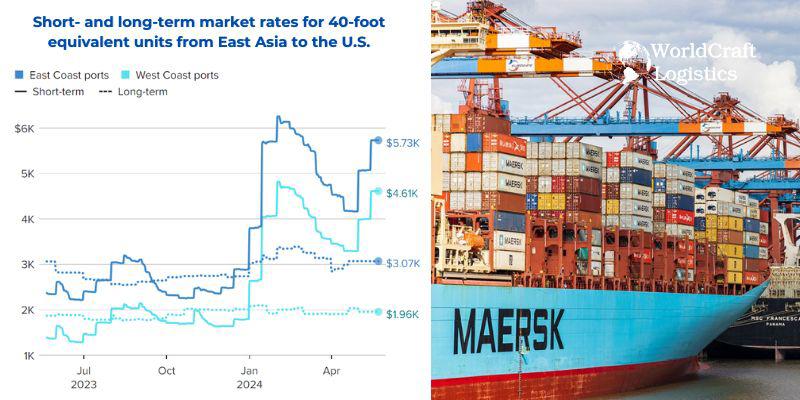

Xeneta's maritime freight prices show a thriving spot market and a growing difference between spot and long-term pricing. Stausbøll emphasizes the possibility of freight roll-over, which is already happening as the gap between long and short-term rates grows.

While spot rates initially fell following the significant escalation caused by tensions in the Red Sea in early 2024, they began to rise again by the end of April, with average surges reaching up to $1,500 for voyages to the United States' coasts. Currently, some of the highest contract rates imposed by shippers are more than double those of a month ago.

Stausbøll compared the current predicament to the chaos produced by limited capacity during the Covid-19 pandemic. "Similar to that period, some freight forwarders are now compelled to resort to premium rates to secure space guarantees," she said.

According to preliminary data from Xeneta, interest rates are expected to rise further at the start of June.

DHL has been warning of a container constraint since January, citing the need for longer routes to avoid the Red Sea following the outbreak of Houthi hostilities. Containers spend more time at sea and are therefore unavailable for reloading. Furthermore, unfavorable weather conditions affecting port operations in China, Malaysia, and Singapore have made container availability even more limited.

Despite earlier projections by numerous logistics experts of abundant ship and container capacity following the global freight recession, Goetz Alebrand, head of Ocean Freight Americas at DHL Global Forwarding, has stated that "vessel space on many trade routes is unable to meet market demand." Alebrand elaborates, "Trade routes from Asia to Latin America, trans-Pacific routes, and Asia to Europe are all experiencing space constraints. These shortages impact specific locations, select service providers, and particular types of equipment."

Alebrand specifically noted the scarcity of 40-foot containers at China's Chongqing port last week. "With demand remaining high and shipping times increasing, we are closely monitoring the situation to address any potential challenges," he emphasized.

Judah Levine, head of research at Freightos, observed that in March and April, ocean carriers utilized idle ships and vessels from other routes to offset prolonged single-entry voyages, maintain container flow, and largely adhere to weekly departure schedules. "However, this has resulted in a lack of surplus capacity in the market," Levine pointed out.

Severe weather in East Asia in late April exacerbated delays, prompting ocean carriers to skip certain port calls or abbreviate turnaround times at destination ports to compensate for lost time. Consequently, fewer empty containers are being returned to China.

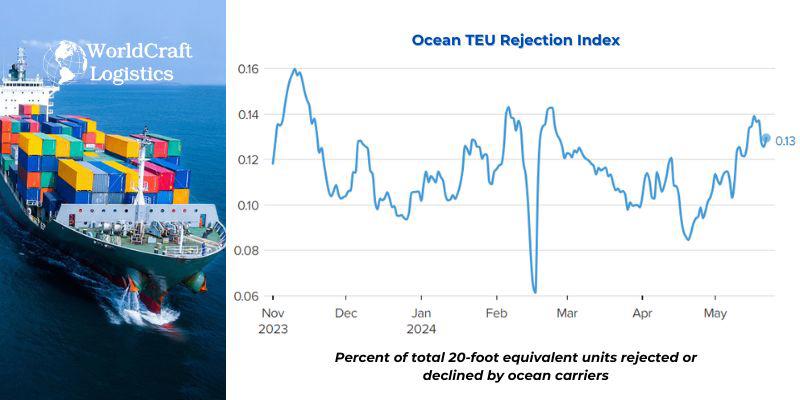

The surge in rejections of ocean freight serves as evidence of imbalances in the market. Levine highlighted, "The recent surge in demand for exports from China, coupled with the decrease in the return of empty containers, is resulting in shippers encountering difficulties in finding empty equipment at certain export hubs. Despite demand levels not reaching extremely high levels, the existing strain on vessel capacity, combined with the recent uptick in demand, is sufficient to drive rates upward. The scarcity of containers further exacerbates this situation, contributing to even higher rate increases."

Read more:

👉 Trans-Pacific container prices continue to DECREASE WITHOUT BRAKES

👉 Why the Second Half of 2024 looks promising for freight industry

👉 Worries regarding rising container shipping costs following incidents in the Red Sea

This recent surge in ocean freight rates follows a previous peak earlier in the year, during which Levine characterized a "floor" ranging from $3,000 to $5,000 per container. At that time, prices were double compared to a year ago.

The increases in logistics prices eventually trickle down to consumers, and the staggering freight rates during the pandemic were cited by the Federal Reserve as a contributing factor to inflation. In a series of customer alerts, logistics providers are cautioning shippers worldwide, including major retailers, about the container shortage.

"Carriers are currently facing a severe equipment shortage due to prolonged congestion, blank sailings, increased demand due to South America tariff implementation, and other factors," Orient Star Group warned in a note to clients. "Numerous shipments are being delayed due to equipment shortage, resulting in significant backlogs. Consequently, space availability is expected to become much tighter in the market. We are urging shippers to arrange for the pickup of empty containers as early as possible to secure resources well in advance."

A new round of general rate increases slated for June 1 has Orient Star Group describing the additional $1,000 charge as carriers becoming "greedy" amidst the sudden surge in demand.

MSC, the world's largest ocean freight company, announced new rates ranging from $8,000 to $10,000 for 40-foot containers to the U.S. West Coast, effective from May 15 to May 31.

Wan Hai has indicated it will levy a premium for "space protection."

According to a note to clients from Honour Lane Shipping, the "significant rate increases" could propel the market to a new post-pandemic high. "While spot rates continue to skyrocket, capacity out of Asia is further tightening," HLS conveyed to clients, noting that this has enabled carriers to implement a "diamond rate ... played during the pandemic period."

Citing the re-routing of ships around the Horn of Africa due to issues in the Red Sea, which accounts for 17% of global container shipping capacity, HLS cautioned that ship cancellations or blank sailings will only exacerbate the pressure of soaring freight rates.

"Carriers have ample room to manipulate capacity," HLS stated, highlighting an increase in blank sailings in May and June.

Maritime shipping research firm Drewry reported a total of 17 sailings canceled on the Transpacific route between weeks 20 and 24 on the shipping calendar, with available space shrinking "significantly" to the U.S. East Coast.

HLS noted that the headwinds are unlikely to ease anytime soon, especially with the U.S. consumer economy remaining robust. With U.S. retail sales forecasted to increase between 2.5% and 3.5% in 2024, HLS anticipates that the current market trend and space situation will persist at least through June.

"Regardless of the headlines about the economy, consumers are actively shopping, and retailers are ensuring they have sufficient merchandise on hand to meet demand," remarked Jonathan Gold, vice president for supply chain and customs policy at NRF. "Restocking may have only just begun," he added.

The delays stemming from extended transits, container shortages, and adverse weather conditions will only compound the challenges faced by logistics managers as they accelerate the movement of freight for the upcoming holidays and back-to-school season. The surge in rates follows a period of tense negotiations in March between shippers and clients, fueled by the Red Sea diversions and the impact of prolonged transits.

Logistics managers had previously informed in March of their decision to advance the peak season from July to June to mitigate potential delays arising from labor disputes or strikes at East Coast or Gulf ports in the fall. U.S. companies are keen to ensure timely arrival of seasonal goods to meet consumer demand, as late arrivals could result in products being sold at discounted rates. The frontloading of holiday and back-to-school products was reaffirmed in CNBC's recent Supply Chain Survey.

The International Longshoremen's Association (ILA), representing longshoremen at East Coast and Gulf ports, holds a master contract with the United States Maritime Alliance (USMX), representing terminal operators and ocean carriers, set to expire on September 30. However, the union established a cutoff date of May 17 for local contracts to be finalized, paving the way for negotiations on the overarching master contract.

As of now, there have been no updates on the conclusion of local negotiations, and details of any tentative agreements remain undisclosed. The ILA and USMX have indicated that face-to-face meetings are likely to be scheduled following the conclusion of local talks. Negotiations for the six-year contract officially commenced in February.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023