Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

08/14/2024

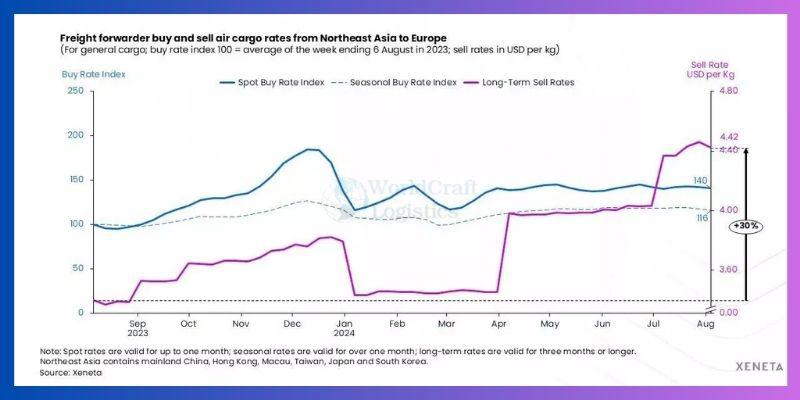

Long-Term General Cargo Rates Reach $4.42 per kg by Mid-August, Up 30% Year-on-Year

The air freight market from Northeast Asia to Europe, already experiencing heightened activity, has reached the highest rates in nearly a year and a half. According to the latest update from Xeneta, by the first half of August, newly contracted long-term general cargo sell rates hit $4.42 per kg, marking a 30% year-on-year increase.

While the peak season surcharges introduced in May and June have been removed, the rising base rates were sufficient to drive the market upward. A similar trend was observed in freight forwarder buy rates, with the seasonal buy rate (valid for more than one month) increasing at a slower pace (+16% year-on-year) compared to the sell rates.

The report noted that when examining forwarder buy spot rates (valid for up to one month), their growth serves as a leading indicator for the market, typically preceding movement in forwarder sell rates on this corridor by approximately nine weeks. In early August, the forwarder buy general cargo spot rate grew by 40% year-on-year, outpacing the growth in forwarder sell rates (+30% year-on-year). This general cargo spot rate growth also exceeded the global average spot rate growth by the same ratio.

Key drivers for this growth include strong e-commerce demand and a revival in semiconductor demand, fueled by high-performance computing and the AI boom. However, as Europe enters its summer vacation period, there are signs that forwarder buy spot rates may be peaking after cargo volume on this corridor reached its peak in mid-June. This development aligns with trends in ocean container shipping, where spot rates from Northeast Asia to Europe decreased by 2% in August after peaking in late July.

Looking ahead, airlines remain optimistic about the year-end peak season and appear better prepared this time around, according to the update. Several airlines are increasing capacity on the Northeast Asia to Europe corridor, with some even shifting freighter capacity away from Latin America.

With more than one-third of cargo volumes still procured by freight forwarders in the spot market (10 percentage points above pre-pandemic levels), shippers need to take proactive measures. They should align with freight forwarders on peak season strategies before freight rates become uncomfortably high.

However, one caveat remains: consumer spending in Europe continues to be subdued, along with fears of a global recession following a recent weak U.S. jobs report. If upcoming cargo demand loses momentum due to shippers frontloading imports during the typically slower summer season, the end of 2024 may be less robust than anticipated.

Additionally, continued geopolitical unrest in the Middle East and Ukraine, strong demand for low-value e-commerce, and an early Chinese New Year in 2025 could be enough to keep air cargo rates elevated.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023