Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

04/25/2024

In the dynamic world of global commerce, Canada is making waves as a notable player in the seaborne coal export market. According to the latest insights from shipbroker Banchero Costa, Canada's export trajectory has seen a remarkable surge, a trend that not only persisted throughout 2023 but continues to gather steam in 2024.

Banchero Costa's recent weekly report underscores the resurgent vigor in global coal trade, which has regained its pre-pandemic momentum. Figures gleaned from vessel tracking data provided by AXS Marine reveal a substantial uptick in seaborne coal loadings worldwide. In the span of Jan-Dec 2023 alone, global coal shipments surged by an impressive 5.8% year-on-year, totaling a staggering 1,339.5 million metric tons (excluding cabotage).

The positive momentum carried into Jan-Feb 2024, with global coal loadings witnessing a notable uptick of 9.3% year-on-year, soaring to 213.9 million metric tons from 195.6 million metric tons recorded during the same period in the preceding year. Noteworthy increases in coal exports were observed particularly from Indonesia, registering a robust 17.4% year-on-year growth to reach 83.7 million metric tons, and Australia, posting a commendable 16.6% year-on-year increase to hit 56.4 million metric tons. However, Russia experienced a downturn, with exports plummeting by 18.2% year-on-year to 23.4 million metric tons in Jan-Feb 2024.

Despite the global landscape's fluctuations, Canada maintains its upward trajectory in coal exports. The data indicates a resilient 3.3% year-on-year increase, amounting to 7.4 million metric tons in Jan-Feb 2024. Conversely, Mozambique faced a downturn, witnessing an 18.6% decrease year-on-year to 2.8 million metric tons during the same period.

These statistics underscore Canada's growing significance in the global coal market, affirming its status as a key player in the realm of seaborne coal exports amidst an ever-evolving economic landscape.

Banchero Costa's latest findings reveal a nuanced landscape in global coal trade dynamics, with significant shifts observed in the import patterns of key consuming nations.

Mainland China emerges as a pivotal player, with seaborne coal imports experiencing a remarkable surge of 22.7% year-on-year to reach 57.9 million metric tons during Jan-Feb 2024. Similarly, India demonstrates robust growth, with seaborne coal imports soaring by 24.9% year-on-year to hit 39.0 million metric tons during the same period.

However, the situation presents a mixed bag for other major importers. Japan, a traditionally significant importer, faced a notable decline of 13.3% year-on-year in Jan-Feb 2024, with seaborne coal imports plummeting to 26.0 million metric tons. South Korea, on the other hand, witnessed a modest uptick of 0.7% year-on-year, with seaborne coal imports totaling 20.7 million metric tons during the same period. The European Union, however, recorded a substantial decrease, with seaborne coal imports witnessing a staggering 45.6% year-on-year decline to 11.1 million metric tons in Jan-Feb 2024.

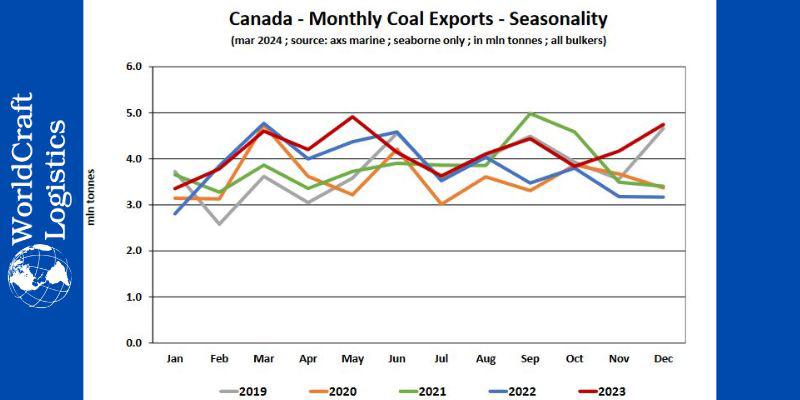

In the global context, Canada emerges as a significant coal exporter, ranking as the seventh-largest globally. In 2023, Canada accounted for 3.4% of global seaborne coal shipments, highlighting its notable presence in the market. Furthermore, Canada's seaborne coal exports in the twelve months of 2023 showcased a commendable 9.6% year-on-year increase, totaling 49.9 million metric tons. This positive growth trajectory follows a slight decline of 0.9% year-on-year in 2022 and a robust 7.1% year-on-year increase in 2021, indicating Canada's resilience and growing influence in the global coal export arena.

These insights from Banchero Costa underscore the dynamic nature of global coal trade, influenced by various economic factors and geopolitical dynamics, with Canada positioned as a notable player in this complex ecosystem.

The latest data provided by Banchero Costa paints a comprehensive picture of Canada's coal export landscape, offering insights into both production trends and destination markets.

Over the first two months of 2024, Canada's coal exports continued their upward trajectory, registering a 3.3% year-on-year increase to 7.4 million metric tons, compared to 7.1 million metric tons in Jan-Feb 2023, and 6.7 million metric tons in Jan-Feb 2022. It's notable that Canada's coal production is evenly split between thermal and metallurgical coal, with the latter dominating its export profile. The provinces of Alberta and British Columbia play a pivotal role, jointly contributing 85% of Canada's coal output, with approximately half of this production earmarked for export. Notably, the bulk of Canadian coal exports are dispatched from ports situated along the British Columbian coastline, predominantly from Vancouver and Prince Rupert.

In terms of vessel types utilized for export, Capesize vessels constituted 40.1% of the coal loaded in Canada in 2023, followed closely by Post-Panamax tonnage at 35.6%, and Panamax tonnage at 22.1%.

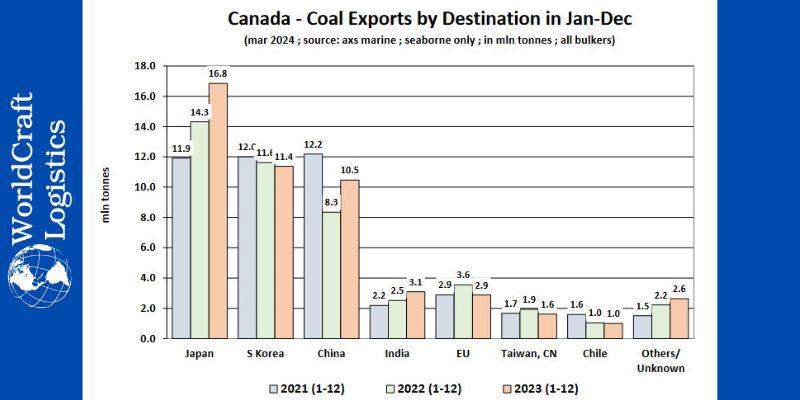

Highlighting the geographic distribution of Canada's coal exports, Banchero Costa underscores Asia's prominence as the primary destination. Japan stands out as the top importer, receiving 33.8% of Canada's seaborne coal exports in 2023. During Jan-Dec 2023, coal exports to Japan surged by 17.6% year-on-year to 16.8 million metric tons. South Korea follows closely, accounting for 22.8% of Canada's exports, although experiencing a slight decline of 2.1% year-on-year in 2023 to 11.4 million metric tons. Mainland China claims the third spot, with a 21.0% share in 2023, witnessing a robust 25.4% year-on-year increase to 10.5 million metric tons. India and the EU round out the top five destinations, with respective shares of 6.2% and 5.8% in 2023, though experiencing divergent trends with India's imports growing by 22.8% year-on-year and the EU's imports declining by 18.8% year-on-year.

This comprehensive analysis underscores the intricate interplay between production dynamics, export destinations, and global market forces shaping Canada's coal trade landscape.

See some of our other articles:

👉 Anticipating the Next Disruption in Supply and Production

👉 Port of Los Angeles Sees 19% Year-on-Year Increase in Cargo Volumes for March

👉 Red Sea crisis is expected to last at least into second half of 2024

*The article collected data from Hellenic Shipping News, we have selected and rewritten it into another article, the data remains the same. If you have comments or special requests, please contact Worldcraft Logistics.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023