Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

09/22/2024

In a recent seminar co-hosted by law firm Reed Smith and the class society DNV, Principal Market Analyst Jakub Walenkiewicz delivered a compelling analysis of the current state of the shipping market, emphasizing that recent developments have been driven more by disruption than by traditional economic indicators. This perspective challenges conventional microeconomic models, which typically focus on predicted demand for commodities transported by vessels.

Walenkiewicz opened his presentation with a stark reminder: “Disruption, by definition, can’t be forecast.” This statement set the tone for his analysis, where he highlighted the impact of external uncertainties on the shipping industry. He specifically pointed to the supply side of shipping, stating, “We’ve been fueling the shipping markets with miles…,” referencing the increasing operational capacities that have been stretched in recent years.

Historically, shipping market forecasts have relied heavily on supply and demand analytics. However, Walenkiewicz argued that recent events have fundamentally altered this landscape. “History teaches only one thing. It has never taught anyone anything,” he remarked, implying that the unpredictable nature of global events has rendered traditional forecasting methods less effective.

His data-driven presentation detailed significant market developments, particularly in the tanker and containership sectors. Key events like the Russian invasion of Ukraine in early 2022 and subsequent disruptions in the Red Sea beginning in late 2023 have significantly influenced shipping dynamics.

Our other articles:

👉 With the advent of Premier Alliance in 2025, there will be new shipping requirements

👉 Air cargo carriers on the Northeast Asia-Europe route must pay more in the summer

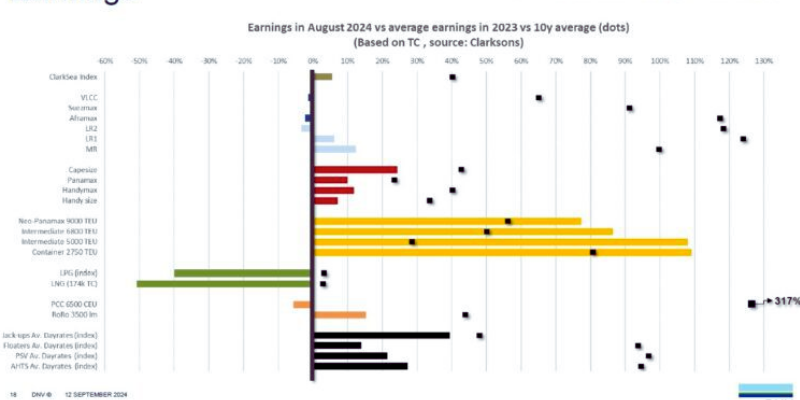

According to Walenkiewicz, the current state of the shipping market is characterized by unprecedented cash flow. “Shipping is absolutely swamped with cash,” he noted, showcasing earnings for various ship types in Q3 2024. His analysis revealed substantial accumulations of cash compared to the previous decade, challenging the notion that market performance is solely dictated by supply and demand fundamentals. “It’s not a pure supply and demand…it doesn’t come from a solid growth of the economy,” he explained.

He elaborated on how changing consumer spending patterns during the COVID-19 pandemic led to inefficiencies within the shipping sector, particularly for container operators. The ensuing boom in the tanker market was driven by longer voyages resulting from the Ukraine conflict, which dramatically increased cargo flows and ton-miles.

Walenkiewicz presented striking statistics to illustrate his points. Comparing 2024 to 2021, he noted a 6% increase in crude oil ton-miles and a 12% increase in refined product ton-miles. He emphasized the operational challenges posed by this surge in demand, stating, “Ton-miles were driven absolutely through the roof for a fleet that was not ready to produce that much productivity.”

Furthermore, he discussed the emergence of a shadow fleet, with nearly 20% of the tanker fleet now engaged in transporting Russian oil despite sanctions. This shift underscores the evolving landscape of the shipping market, where compliance and operational adaptability have become paramount.

Walenkiewicz challenged the traditional belief that the shipping market operates on a cycle of “one good year and subsequently seven bad years.” He posed a rhetorical question: “How often do you have a situation where nearly every part of the market is earning at levels above its ten-year average?” This observation highlights the current market anomaly, where even reduced vessel scrapping has led to an overheated newbuild market.

In his closing remarks, Walenkiewicz turned his attention to the wet sector, explaining why investors are increasingly focused on tankers. He stated, “This is why people decide to go after tankers…it is not unreasonable to think — if you get yourself a super-efficient vessel, in three years’ time from now, you most likely will be able to run the vessel with much higher time-charter or spot rates.” This insight reflects a strategic shift towards acquiring vessels that promise greater efficiency and profitability, regardless of market fluctuations.

Jakub Walenkiewicz’s presentation provided valuable insights into the complexities of the shipping market, emphasizing that disruption is now a primary driver of market dynamics. As industry players navigate this unpredictable landscape, adapting to these changes will be crucial for future success. The insights shared in this seminar are not just a reflection of current trends but also a call to rethink traditional approaches to shipping economics.

*The article contains some information and figures from (gCaptain), if there are any issues to consider or special requests, please contact us! Thank you.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023