Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

07/10/2024

Container shipping and the interconnected web of global transport services are entering their typical peak season for demand. However, this year's scenario planning is fraught with uncertainties surrounding supply.

Incidents like vessel diversions in the Red Sea and port congestion have absorbed any surplus capacity the industry had towards the end of 2023, exacerbated by increased Houthi attacks. Spot container rates have surged twofold since early May.

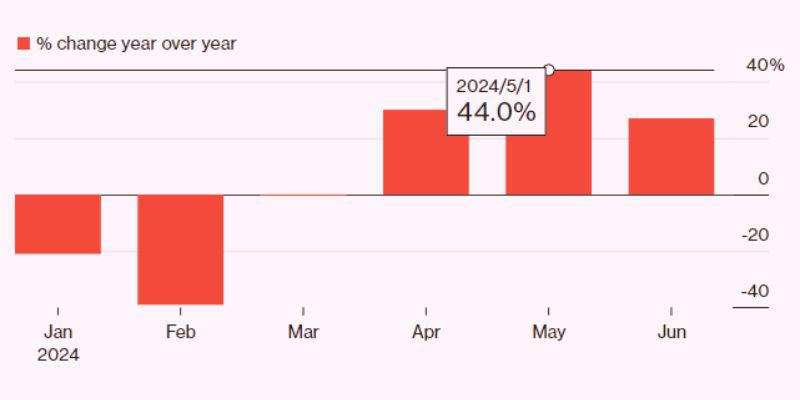

In Singapore, home to the world’s second-busiest port and a crucial cargo transfer hub between Asia and the West, delays in shipments soared by 44% in May compared to the previous year. By June 25th, delays were still up by 27% year-over-year, as reported by FourKites, a platform for supply chain visibility.

"The persistent shortage of available empty shipping containers in key export markets remains a pressing issue," noted Mike DeAngelis, head of international ocean solutions at FourKites. "Containers are ensnared in a global web of delays."

Further exacerbating these bottlenecks is a heightened demand reflex that emerged during the pandemic: a fear of missing out. Anticipations of impending US tariffs on Chinese imports and the potential for strikes at East and Gulf coast ports later in the summer are prompting earlier and increased orders.

Judah Levine, head of research at Freightos, a cargo-booking platform, advises preparing for several more months of strain. He forecasts that spot container rates from Asia to Europe and the US could escalate to $10,000 per 40-foot equivalent unit in the coming months, up from the current $7,000 to $8,000 range. While it would require a combination of other disruptive factors for rates to return to pandemic highs of $15,000 to $20,000, Levine believes such levels are not out of the realm of possibility.

"To me, the most plausible scenario is a couple of months of intense pressure," Levine explained. "We might even see rates climb to $15,000 per container, but unlike the pandemic period, I don't expect it to persist for many months."

For more details, you can refer to the original article on Bloomberg Trade Tracker: "Global Sea Transport Leaps Most Since 2010 After Red Sea Attacks."

Read more: 5 important variables that will affect ocean freight shipping in 2024

Here’s how Levine outlines the scenarios for the second half of the year:

Worst Case Scenario: If ships continue to avoid the Red Sea, early peak-season demand remains strong, and port congestion persists for months, global disruptions could extend beyond the Chinese Lunar New Year starting in late January. If compounded by a strike by dockworkers on the US East and Gulf coasts, container rates could skyrocket to the record highs seen during the pandemic.

Best Case Scenario: This scenario depends on an end to Houthi attacks in the Red Sea, allowing carriers to resume optimal sailing schedules. After an initial adjustment period, cargo rates would sharply decrease as supply exceeds demand. The introduction of newly built ships would help drive the cost for a 40-foot container back to pre-pandemic levels, approximately $1,000 between Asia and the US and Europe.

Most Likely Case Scenario: In this scenario, current strong demand softens, suggesting that early orders were pulled forward from the third and fourth quarters due to concerns over US tariffs on Chinese imports, Red Sea delays, port strike fears, or a combination of these factors. Spot rates might still peak around $10,000 per 40-foot container in the coming months but would likely decrease later in the year.

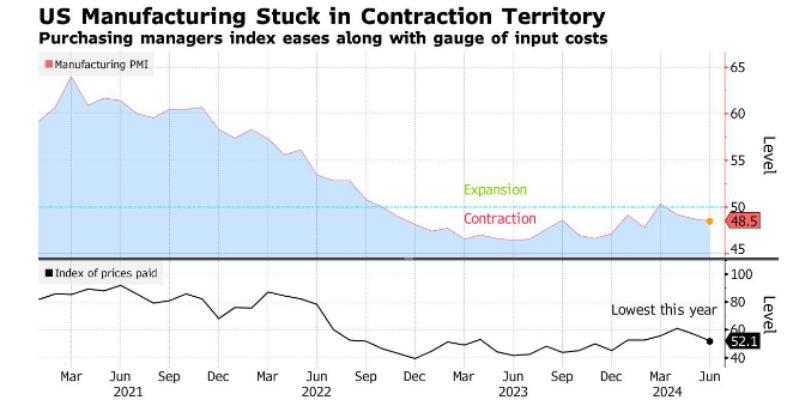

In June, US factory activity continued to contract slightly for the third consecutive month, according to the Institute for Supply Management (ISM). The ISM's manufacturing gauge showed a marginal change, registering 48.5 compared to 48.7 the previous month. This reading remains just below the critical threshold of 50, which separates contraction from expansion in the sector.

Despite the overall contraction, there was a positive note in the form of an uptick in the ISM's new orders gauge, suggesting potential future improvements in demand. Additionally, the measure of prices fell by the largest margin in over a year, indicating easing inflationary pressures within the manufacturing sector.

Read more: Over 2 million TEU are expected at Port of Long Beach in Q1 2024

Here are summaries of today's notable developments:

Maersk Withdraws from DB Schenker Bid: Maersk has decided against bidding for DB Schenker, citing concerns over integration challenges.

Surge in Chinese Plastic Supply: China faces a surplus of plastic production amidst weak domestic demand, potentially impacting global markets.

Indonesia Imposes Tariffs on Textiles: Indonesia plans to implement tariffs and other measures to safeguard its textile industry from Chinese imports.

Mercedes-Benz Plans New Model Launch: Following initial challenges with its first generation of battery-powered cars, Mercedes-Benz prepares for a significant launch of new models.

BYD's Record Sales of Electric Cars: Chinese automaker BYD achieved record sales of electric and hybrid cars in the second quarter, according to Bloomberg News.

Black Sea Mine-Hunting Force: Turkey, Romania, and Bulgaria have initiated a joint mine-hunting force in the Black Sea to enhance shipping safety.

Modi's Visit to Moscow: Indian Prime Minister Narendra Modi will visit Moscow next week for talks with President Vladimir Putin, amid growing China-Russia relations.

These stories highlight significant developments across industries and geopolitical dynamics.

The Bloomberg Supply Chain Intelligence webinar series aims to address the rising complexities in global supply chains, exacerbated by unpredictability in politics, industrial policies, financial markets, and climate patterns. The series focuses on highlighting key trends and issues that influence supply chains globally, and explores their implications for corporations and investors. It serves as a resource to enhance understanding and management of supply chain risks in today's dynamic environment.

Here’s a breakdown based on your requests:

Weakening US Factory Production: Stuart Paul from Bloomberg Economics predicts a continued slowdown in labor demand due to declining US factory production.

US International Trade Commission's Patent Jurisdiction: Following a recent US Supreme Court ruling, the authority of the US International Trade Commission regarding patents is uncertain. Google LLC is moving swiftly to capitalize on this development, as reported by Bloomberg Law.

Bloomberg Terminal Functions:

SPLC [Equity Ticker]: Provides critical data about a company's suppliers, customers, and peers.

AHOY: Tracks global commodities trade flows.

DSET CHOKE: Monitors datasets related to shipping chokepoints.

{BI RAIL}, {BI TRCK}, {BI SHIP}, {BI 3PLS}: Freight dashboards for rail, trucking, shipping, and third-party logistics.

NH FWV: Access FreightWaves content on the Bloomberg Terminal.

BNEF: BloombergNEF’s analysis covering clean energy, advanced transport, digital industry, innovative materials, and commodities.

For automated stories about supply chains and more detailed insights, you can click on the provided links or use these functions directly on the Bloomberg Terminal.

From Porttechnology's documents, the editorial team of worldcraftlogistics.com has re-edited the content to closely follow the main article to be more suitable for users on our website. Hopefully the information is more useful to users. If you have any comments or requests, please contact Worldcraft Logistics.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023