Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

10/14/2024

In the world of business transactions, especially in international trade, clarity and transparency are essential. A proforma invoice is a key tool that provides buyers with a detailed preview of their purchase before the deal is finalized. But what exactly is a proforma invoice, and how can it benefit both buyers and sellers? In this guide, Worldcraft Logistics will break down its purpose, use cases, and why it’s more than just a preliminary document - it’s a foundation for smoother, stress-free transactions.

A proforma invoice (pro forma bill) is a preliminary bill of sale or a quotation sent to buyers in advance of a shipment or delivery of goods. It outlines the terms of the transaction, including the goods or services to be provided, their price, and the expected delivery timeline. However, it does not act as a legally binding document for payment but is more of an agreement in principle between the seller and the buyer. Proforma invoices are commonly used in international trade to provide an estimate of costs before the final commercial invoice is issued.

Other Worldcraft Logistics articles you'll definitely want to read:

👉 Single Entry Bond and Continuous Bond: Meaning, the Differences

👉 What is Customs Clearance? Meaning, procedure and implementation

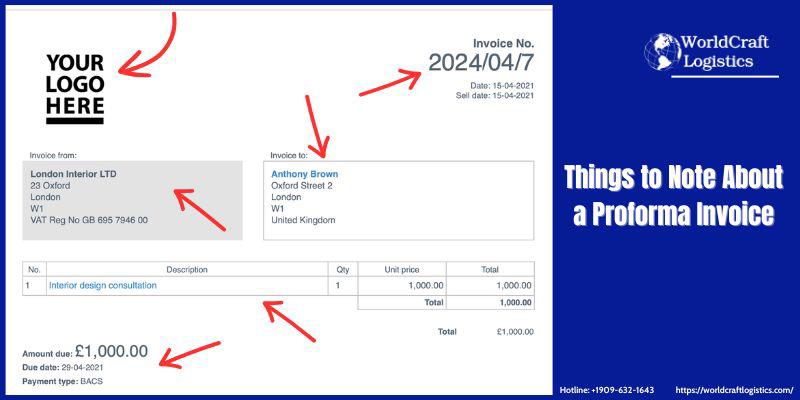

A typical proforma invoice includes the following details:

Seller and buyer information: Names, addresses, and contact details of both parties.

Invoice number: A unique identifier for reference.

Date of issuance: The date the invoice was created.

Description of goods or services: Detailed information about the items being sold, including quantity, weight, volume, or dimensions if necessary.

Unit prices and total amount: The price per item and the overall total.

Terms of sale and payment: Any agreed-upon payment terms, such as payment methods and deadlines.

Delivery information: Estimated shipping date, delivery terms (Incoterms), and destination details.

Currency: The currency in which the payment is expected to be made.

Additional fees: Any taxes, shipping costs, or duties that may apply.

Here is a common sample proforma invoice template that includes all essential details:

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Website]

PROFORMA INVOICE

Invoice Number: [#XXXX]

Date: [MM/DD/YYYY]

Valid Until: [MM/DD/YYYY]

Bill To (Buyer Information):

[Buyer Company Name]

[Buyer Company Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

Ship To (If different):

[Shipping Company Name]

[Shipping Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

DESCRIPTION OF GOODS/SERVICES

| Item No. | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| 1 | [Product Name] | [Quantity] | [Price] | [Total] |

| 2 | [Product Name] | [Quantity] | [Price] | [Total] |

| 3 | [Service Description] | [Hours/Days] | [Rate] | [Total] |

Subtotal: [Subtotal Amount]

Shipping Cost: [Shipping Amount]

Tax (if applicable): [Tax Amount]

Total Amount Due: [Total Amount]

PAYMENT TERMS

Payment Method: [Bank Transfer / Credit Card / etc.]

Payment Due Date: [Due Date]

Bank Details:

Bank Name: [Your Bank Name]

Bank Address: [Bank Address]

Account Number: [Account Number]

SWIFT/BIC Code: [SWIFT/BIC]

IBAN (if applicable): [IBAN]

Shipping Information

Estimated Shipping Date: [Date]

Delivery Terms (Incoterms): [FOB, CIF, etc.]

Shipping Method: [Air, Sea, Courier]

Destination: [Port/City Name]

Special Notes/Instructions:

[Additional information, terms, or conditions that apply to this proforma invoice.]

DECLARATION

This proforma invoice is for quotation purposes only and does not represent a final bill. No goods or services will be delivered until the final commercial invoice is issued and payment is confirmed.

Authorized Signature:

[Your Name]

[Your Title]

[Date Signed]

A proforma invoice plays a crucial role in business transactions, especially in international trade. It's often confused with other types of invoices, but it serves a distinct purpose that separates it from commercial invoices, sales invoices, credit memos, and tax invoices. In this article, we’ll explore how a proforma invoice compares to these other documents to help you better understand their differences and when each is used.

The commercial invoice is a legally binding document issued after the sale is confirmed. It acts as the final bill and is essential for customs clearance in international shipping, containing details about the transaction such as product descriptions, quantities, prices, and payment terms.

✔️ Key Difference: A proforma invoice is a preliminary or estimate of the transaction sent before the final sale, often used for price quotations or to facilitate the import process. In contrast, the commercial invoice is the final document, confirming the sale and acting as a legal demand for payment.

If you want to understand more about Commercial Invoice, the following article by Worldcraft Logistics will help you grasp a lot of necessary information: 👉 https://worldcraftlogistics.com/what-is-a-commercial-invoice-what-should-you-pay-attention-to

A sales invoice is used after the sale of goods or services is completed. It is a request for payment from the buyer, documenting the amount due, the goods or services delivered, and payment terms.

✔️ Key Difference: While a proforma invoice is issued before the transaction is finalized and serves as a non-binding estimate, a sales invoice is sent after the sale and acts as an official request for payment.

A credit memo is issued by the seller to the buyer, typically to correct an overcharge, refund, or to adjust the total amount of a previously issued invoice. It reflects a reduction in the amount owed by the buyer.

✔️ Key Difference: A proforma invoice is used at the start of a transaction, estimating the cost of goods or services. A credit memo, however, is issued after the sale and is used to adjust or reduce the amount due on an existing invoice.

A tax invoice or VAT invoice is required by businesses to show the amount of tax charged on the goods or services provided. This invoice is essential for tax reporting and is issued once the sale has taken place.

✔️ Key Difference: A proforma invoice is not a tax invoice; it does not include tax amounts as it's merely an estimate. A tax or VAT invoice is a formal, legally required document that must be issued after the sale to report taxes for regulatory compliance.

In summary, the proforma invoice serves as an initial step in the sales process, providing an estimate of the transaction details before it's finalized. While it is non-binding and cannot be used for tax purposes, it sets the stage for formal invoicing, ensuring transparency between the buyer and seller before the deal is confirmed. Understanding the differences between a proforma invoice and other invoices ensures you use the correct document at each stage of a business transaction.

A proforma invoice is a useful document in several scenarios during the sales process, particularly when clarity and transparency are needed before finalizing a transaction. Here are the key situations when sending a proforma invoice is appropriate:

Before Finalizing a Sale: It provides the buyer with an estimate of costs, helping them decide before committing to a purchase.

In International Trade: Customs authorities may require it to calculate duties and taxes before goods are shipped.

When Buyers Need Cost Estimates: It offers a formal price breakdown, especially for large transactions.

For Financing: Buyers may use it to secure loans or financing.

Before Custom Orders: It confirms details of custom goods or services before production.

For Internal Approvals: Larger organizations use it to seek approval for purchases.

To Avoid Price Discrepancies: It clarifies terms, preventing misunderstandings before issuing the final commercial invoice.

By using a proforma invoice in these situations, sellers can provide buyers with clarity and transparency, which helps streamline the sales process and ensure smoother transactions.

Creating a proforma invoice involves several key steps to ensure all necessary information is included. Follow this detailed guide to create a professional and accurate proforma invoice for your business transactions:

You can use accounting software, online templates, or create your proforma invoice in Word, Excel, or Google Docs. Make sure the layout is clean, organized, and professional, including your company’s logo and branding if needed.

Company Name and Logo: Include your business name and logo at the top.

Contact Information: Add your company’s address, phone number, email, and website for easy communication.

Buyer’s Name and Address: Provide the full name of the buyer or their company, along with their address.

Contact Details: Add the buyer’s phone number and email for confirmation or queries.

Label the document as a “Proforma Invoice” to distinguish it from other types of invoices or documents.

Description: Provide a detailed description of each product or service, including relevant details such as size, model, or specific features.

Quantity: Specify the number of units for each item or the amount of work to be provided.

Unit Price: Include the price per unit of each product or service.

Total Price: Multiply the unit price by the quantity to calculate the total for each item.

Subtotal: Sum up the total cost of all goods or services before taxes, shipping, or discounts.

Shipping Fees: Include any shipping costs, especially in international trade.

Taxes (if applicable): Add taxes such as VAT or sales tax, if applicable.

Grand Total: Calculate the final total, including shipping fees and taxes.

Payment Terms: Specify how and when the payment should be made, such as the due date and preferred payment method (bank transfer, PayPal, etc.).

Currency: Clearly state the currency in which the invoice will be paid (USD, EUR, etc.).

Incoterms: For international transactions, include the agreed Incoterms (e.g., FOB, CIF) that outline responsibilities for shipping, insurance, and handling.

Delivery Method: Mention the shipping method (air, sea, courier, etc.).

Estimated Delivery Date: Specify the approximate delivery date of the goods or services.

Destination: Indicate the shipping destination or delivery address.

If there are any additional conditions, discounts, or instructions (e.g., lead times, packaging requirements), mention them clearly in a separate section.

State that the proforma invoice is not a demand for payment and that it is only a preliminary invoice that serves as a quotation or estimate.

*Example disclaimer: “This is a proforma invoice provided for informational purposes only. No payment is due until a final commercial invoice is issued.”

Include a space for an authorized signature or stamp if you require a formal acknowledgment.

Proofread: Double-check for any errors in product descriptions, prices, or contact information.

Ensure Accuracy: Make sure all totals, taxes, and shipping fees are calculated correctly.

By following these steps, you’ll be able to create a clear, professional, and accurate proforma invoice that communicates all necessary details to your buyers, helping facilitate smooth transactions.

No, a proforma invoice is not a receipt. A proforma invoice is a preliminary document provided to the buyer before the transaction is finalized, outlining the estimated costs and terms of the sale. A receipt, on the other hand, is issued after the payment has been made, serving as proof of the completed transaction.

The purpose of a proforma invoice is to provide the buyer with an estimate of the goods or services, including prices, quantities, and terms of sale, before the final commercial invoice is issued. It helps clarify details, facilitate customs clearance in international trade, and assist buyers in securing financing or internal approvals. It also allows both parties to agree on the specifics before the sale is finalized.

A proforma invoice example might include details such as:

The seller’s company name and contact information

The buyer’s details

The date of issuance and proforma invoice number

A list of products or services with descriptions, quantities, unit prices, and total prices

Payment terms, shipping information, and any applicable taxes or duties

A disclaimer stating it is for quotation purposes only and not a demand for payment

Example: A company selling 100 units of a product might send a proforma invoice detailing the cost per unit, shipping fees, estimated taxes, and a total price, allowing the buyer to review the order before confirming the purchase.

Proforma invoices are used by a variety of businesses and individuals, including:

Exporters and Importers: In international trade, proforma invoices help buyers and sellers clarify the terms before shipping and assist with customs procedures.

Manufacturers: When a buyer requests a custom product, manufacturers use proforma invoices to outline the costs before production begins.

Service Providers: Freelancers or service-based businesses can issue a proforma invoice to estimate the cost of services to be provided.

Buyers: Buyers may request a proforma invoice to review the cost or secure internal approval before completing a transaction.

Technically, no - you should not pay a proforma invoice directly because it is not a final bill or demand for payment. A proforma invoice is a preliminary document for informational purposes. The final payment should be made against a commercial invoice, which is issued after the proforma invoice, confirming the sale and providing the legally binding details required for payment.

However, some businesses may use proforma invoices to request upfront payment in certain situations, but it’s crucial to ensure the terms are clear before proceeding with any payment.

A proforma invoice goes beyond just being a simple quote; it’s a vital part of the buying and selling process, ensuring both parties are aligned before money or goods change hands. Whether you're a buyer looking for transparency or a seller providing clarity, mastering the use of proforma invoices can significantly enhance your business dealings and lead to more successful, worry-free transactions.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Education

01/05/2025

Education

02/18/2025

Education

01/01/2024

Education

09/09/2025

Education

08/28/2024