Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

02/20/2023

Companies facing a disconnect between supply and demand, along with a lack of warehouse space, are increasingly storing goods in ad hoc arrangements such as truck trailers and parking lots. This is according to Chuck Cannata, executive vice president and general manager of transportation equipment lessor Milestone Equipment Holdings LLC, which has seen rising demand for trailers as storage in the past two years.

The strategy is mobile and accessible, making it possible to move inventory to a retail distribution center or a store without touching it multiple times. However, this approach exacerbates the already-stressed supply chains, tying up shipping containers, truck trailers, and truck frames, making it harder for trucking companies and ocean carriers to access the equipment they need at the right time and place.

The trend underscores how retailers and manufacturers are continuously adjusting their distribution operations to keep their supply chains running, despite disruptions in transportation networks and forecasting difficulties. This is especially important given the highly squeezed warehouse market, with vacancy rates in some major distribution markets falling to the low single digits and leasing costs on the rise.

A recent report by JLL reveals that average rental rates across the US for industrial properties surpassed $8 per square foot in Q2, which is 21% higher than the same quarter last year. While using transport equipment for storage is a scalable solution, it is not sustainable in the long run, as it creates further strains on supply chains that are already struggling to cope with the ongoing supply-demand imbalance.

Keeping goods on transport equipment ties up shipping containers, truck trailers, and frames, straining supply chains, according to shipping experts. More sustainable solutions are needed to address the supply-demand imbalance in the current market.

The downside of using trailers for storage is that it ties up equipment that could be used for transporting other goods. Lisa Ellram, a professor of supply chain management at the Miami University Farmer School of Business in Ohio, warned that this approach is not a sustainable solution.

Some retailers, such as Target and Macy's, are cutting prices to clear out their excess inventories quickly. Others are holding on to late-arriving goods for future sales or diverting shipments to off-price retailers like Ross Stores and Burlington Stores, which shifts the inventory-management challenges to other companies.

Joe Trusner, executive sales director at freight broker Total Quality Logistics, reported that the company's revenue from providing drop trailers, which are unhooked truck trailers left with shippers, surged by 849% in the first half of 2021 compared to the same period in 2020. He added that one retailer that received Christmas goods too late for last year's holiday season has stored the merchandise this year in more than 50 trailers across the country.

Experts say that the tactic is designed to keep supply chains nimble and to help companies avoid costly commitments to new storage capacity amid the uncertainties in the US economy and changes in consumer buying patterns.

Container-ship backlogs from New York to Houston are further straining troubled US supply chains. WCL explains the causes of the congestion and its impact on the economy.

Shippers leasing short-term warehouse space are also exploring the possibility of storing trailers in the parking lots of these properties, said Karl Siebrecht, CEO of Flexe, which connects businesses to warehouses with extra storage space. This approach is a temporary solution that enables companies to park their trailers while waiting for inventory to move down the supply chain.

For some large retailers with their own trucking fleets, using trailers for ad hoc storage is a standard practice during seasonal surges. Dr. Ellram notes that these companies plan for it, knowing that the inventory will move quickly and that it's not worth investing in additional distribution center capacity.

While using transport equipment as a storage solution is an innovative approach, it is not sustainable in the long run. Companies must find more sustainable solutions to address the underlying supply chain issues and to cope with the ongoing supply-demand imbalance.

Developer

Warehouse

12/30/2024

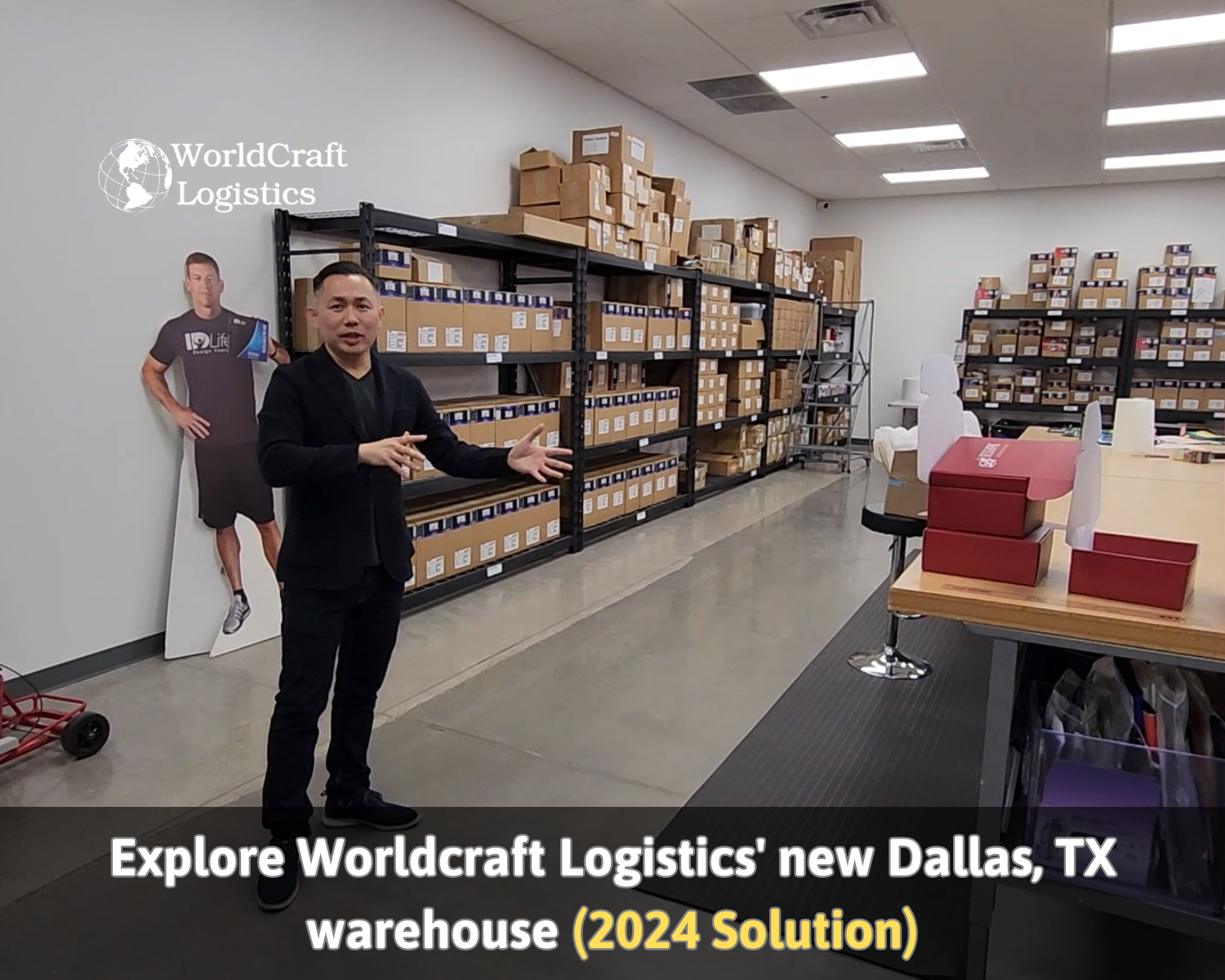

Warehouse

06/16/2024

Warehouse

03/03/2024

Warehouse

08/25/2024

Warehouse

02/20/2023