Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

02/20/2023

Slowing Warehouse Development May Prolong Space Squeeze, Experts Say.

Companies are scaling back their construction ambitions as borrowing rates rise.

For the last few quarters, companies have halted their lease of additional warehouse space. An Amazon warehouse project in Syosset, New York, shown picture.

The slowing pace of warehouse construction in the US could prolong the ongoing shortfall in logistics space, according to industry experts. Developers are pulling back on building plans in the face of rising interest rates and declining leasing activity, which could lead to a shortage of industrial real estate. US industrial construction starts dropped 24% in the fourth quarter of 2022 compared to the same period a year earlier. This represents the lowest amount of new space to start construction in a quarter since the beginning of the COVID-19 pandemic.

Developers began building about 137 million square feet of new warehouse space, and the average time it takes for large industrial projects to complete construction is about 13 months. This means that current decisions on whether to break ground on developments will have an impact next year.

The deceleration in new construction marks a sharp shift from the fast-paced warehouse expansion during the pandemic. During that time, companies leased record-high amounts of space to respond to a surge in e-commerce orders, which drove vacancy rates to multi-year lows. E-commerce giant Amazon doubled the size of its fulfillment network in 24 months as business surged during the pandemic, but last year began slowing its logistics expansion and said it would sublease some of its warehouses.

Companies signed leases for 132 million square feet in the fourth quarter of 2022, down 28.2% compared to the third quarter and a drop of 37.2% from the previous year, according to commercial real-estate services firm Cushman & Wakefield.

The national average vacancy rate ticked up to 3.3% from 3.1% the prior quarter. This was the second consecutive quarter vacancy increased after two years of shrinking availability, though the rate remains far below the 5% average vacancy rate in 2020. The slowdown in new development contrasts sharply with the pandemic's rapid warehouse expansion.

The slowdown in new development contrasts sharply with the pandemic's rapid warehouse expansion.

The Worldcraft, a logistics and real estate firm, said developers have begun pulling back on construction starts amid rising building and financing costs and pressure on property values. At the same time, hard costs to build warehouses are rising while the prices that developers can sell them for is declining.

“Developers’ profit margins are basically coming under pressure from both sides,” said Adrian Ponsen, national director of U.S. industrial market analytics at CoStar Group Inc. “At the same time that the hard costs to build these warehouses is rising, the prices that developers think they can ultimately sell them for is beginning to decline.”

The world’s largest builder of logistics properties, Prologis Inc., has curtailed its development plans for this year. The company is planning development starts for the year to range between $2.5 billion and $3 billion, down from $4.7 billion in construction starts last year.

Meanwhile, Worldcraft is monitoring how quickly new space is being leased before launching new projects.

“Why go out there and put a bunch of space on the market if you have an option of being more cautious and metering it in as you see the year unfolding?” said Hamid Moghadam, chief executive of Prologis.

Despite construction starts slowing down, the pipeline of industrial projects being built remained elevated at 682.6 million square feet as of the fourth quarter, according to Cushman & Wakefield. The company said that developers completed 143.6 million square feet of new space to finish the year, down from the record-high 148.2 million square feet delivered in the third quarter.

Developer

Warehouse

12/30/2024

Warehouse

06/16/2024

Warehouse

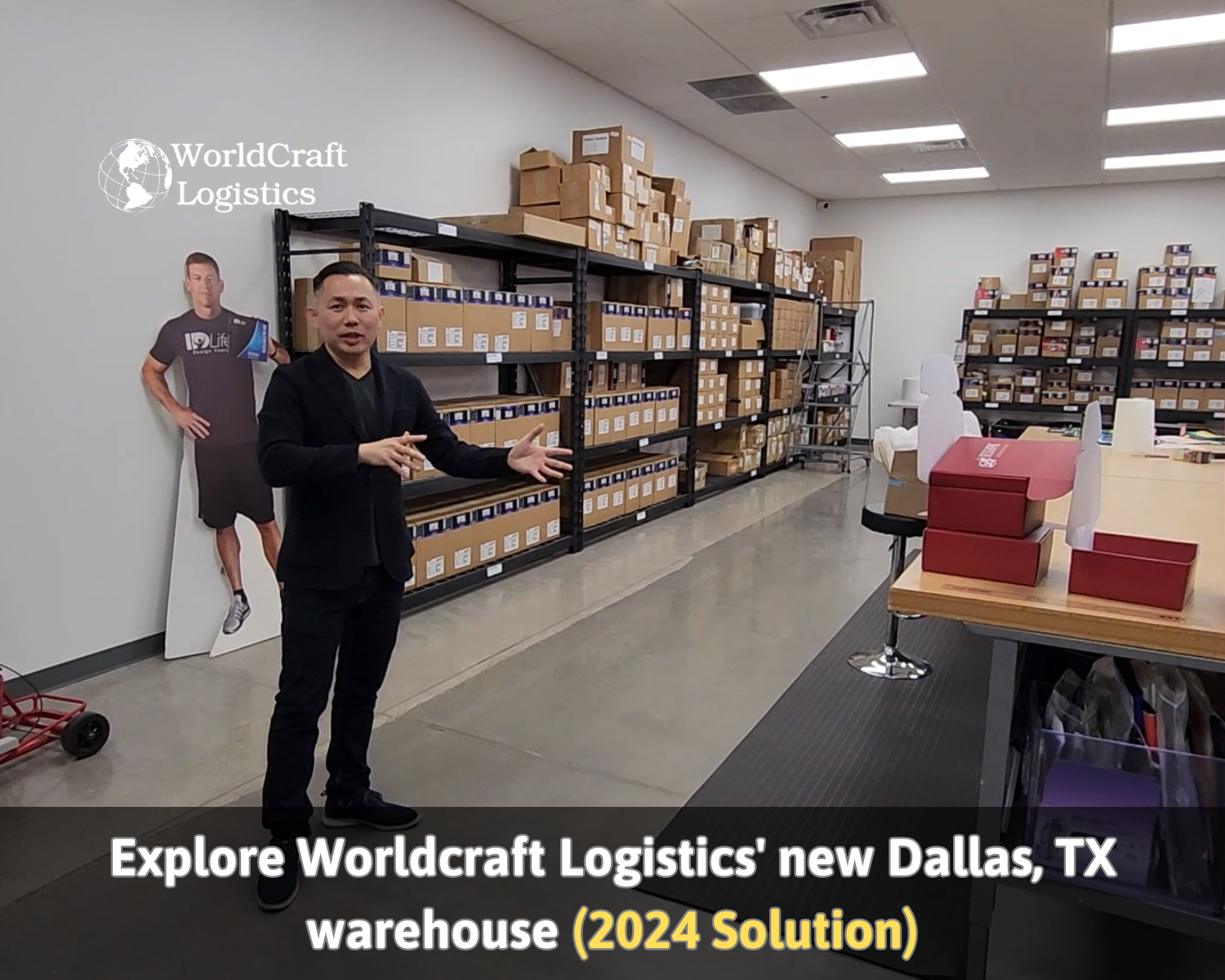

03/03/2024

Warehouse

08/25/2024

Warehouse

02/20/2023