Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

02/27/2024

Key shipping routes in the Red Sea, Black Sea, and Panama Canal are currently facing threats, with significant implications for global inflation, food, and energy security. Recent attacks on commercial vessels in the Red Sea have severely disrupted shipping through the Suez Canal, exacerbating existing geopolitical and climate-related challenges in global trade and supply chains, as outlined in a new report by UNCTAD released on 22 February.

The crisis in the Red Sea compounds the ongoing disruptions in the Black Sea due to the Ukraine war, leading to shifts in oil and grain trade routes and disrupting established patterns. Additionally, the Panama Canal, a vital link between the Atlantic and Pacific oceans, faces a separate challenge: diminishing water levels. These declining water levels raise concerns about the long-term resilience of global supply chains, highlighting the fragility of the world's trade infrastructure.

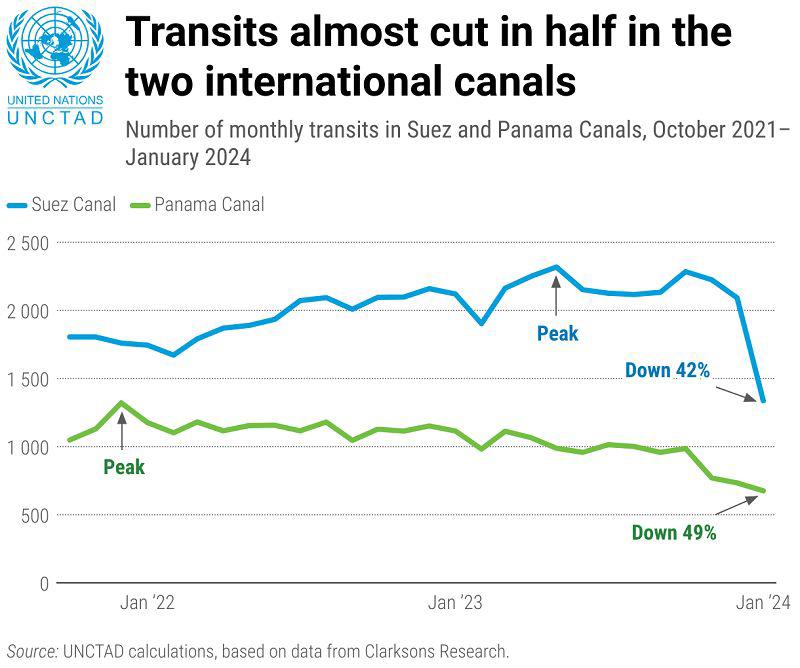

UNCTAD's estimates indicate a 42% decrease in transits passing through the Suez Canal compared to its peak. Major players in the shipping industry have temporarily suspended Suez transits, resulting in a 67% decrease in weekly container ship transits, as well as significant declines in container carrying capacity, tanker transits, and gas carriers.

Similarly, total transits through the Panama Canal have dropped by 49% compared to their peak levels.

Recent attacks on shipping have severely disrupted maritime trade routes in the Red Sea, particularly via the Suez Canal, intensifying challenges in the global trade landscape. This disruption compounds existing issues in the Black Sea due to the Ukraine war, causing shifts in oil and grain trade routes.

Furthermore, the Panama Canal, crucial for connecting the Atlantic and Pacific Oceans, faces a distinct challenge: declining water levels. These diminishing levels raise concerns about the long-term resilience of global supply chains, highlighting the fragility of the world's trade infrastructure.

UNCTAD estimates a 42% decrease in transits through the Suez Canal compared to peak levels. Major players in the shipping industry have temporarily suspended Suez transits, leading to a 67% reduction in weekly container ship transits, as well as significant declines in container carrying capacity, tanker transits, and gas carriers. Similarly, total transits through the Panama Canal have dropped by 49% compared to their peak levels.

The decision to avoid the Suez Canal, opting instead to reroute around the Cape of Good Hope, carries significant economic and environmental consequences, placing added strain on developing economies.

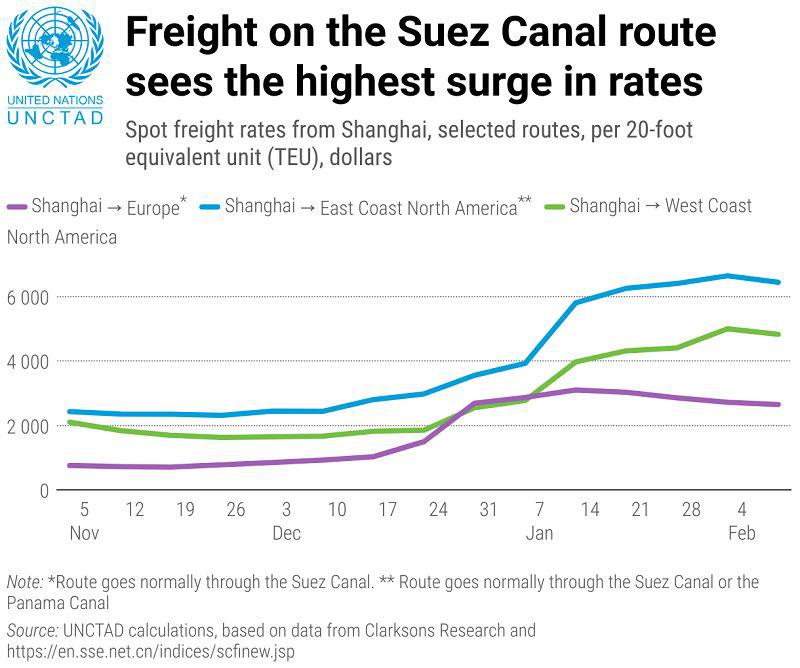

Since November 2023, there has been a substantial increase in average container spot freight rates, reaching record highs with a weekly surge of $500 by the end of December. This trend persists, with container shipping rates from Shanghai more than doubling since early December (+122%), tripling to Europe (+256%), and significantly rising to the United States West Coast (+162%), despite bypassing the Suez Canal.

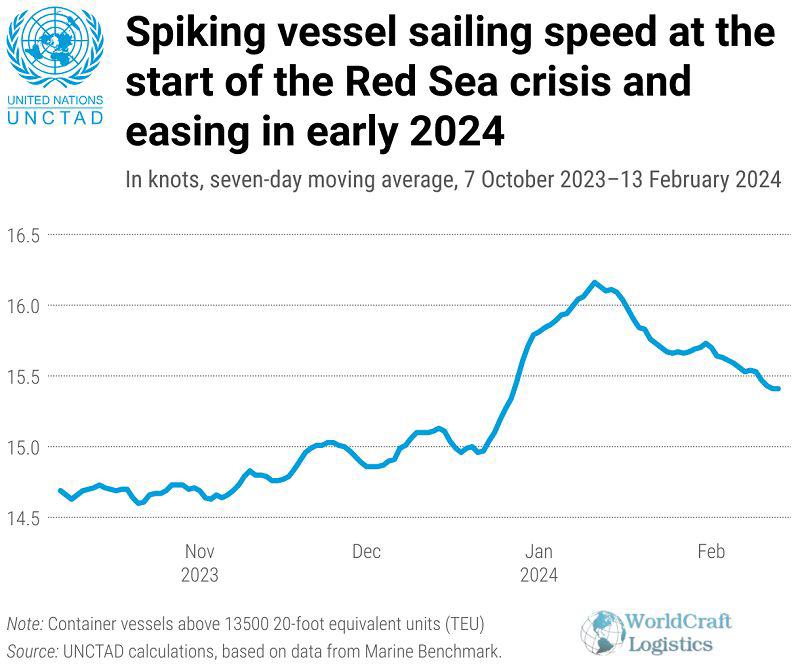

Ships are circumventing both the Suez and Panama Canals, opting for alternative routes, resulting in longer travel distances, elevated trade costs, and increased insurance premiums. Moreover, greenhouse gas emissions are on the rise due to the need for ships to travel greater distances at higher speeds to compensate for these detours.

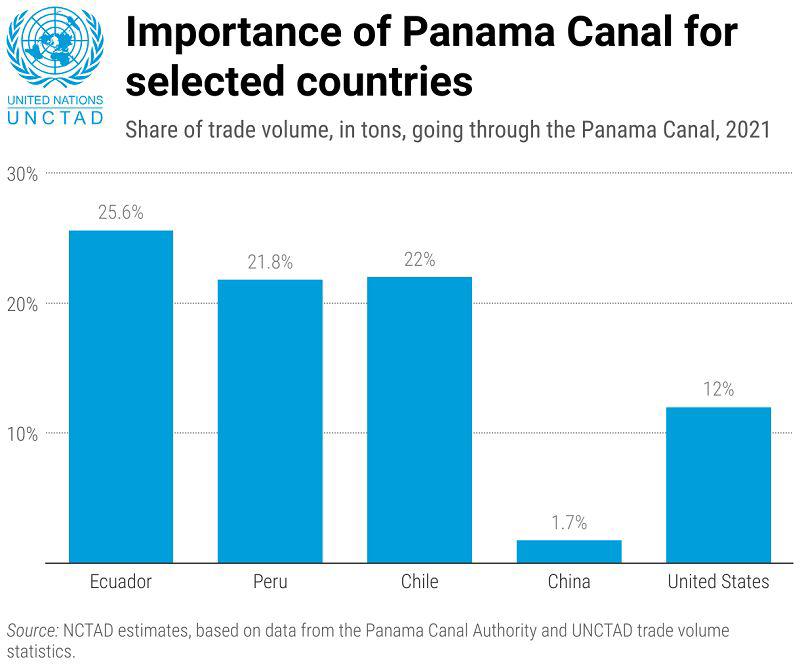

The Panama Canal holds particular importance for the foreign trade of countries on the West Coast of South America, with approximately 22% of total Chilean and Peruvian foreign trade volumes relying on the Canal. Ecuador is the most dependent, with 26% of its foreign trade volumes crossing the Canal.

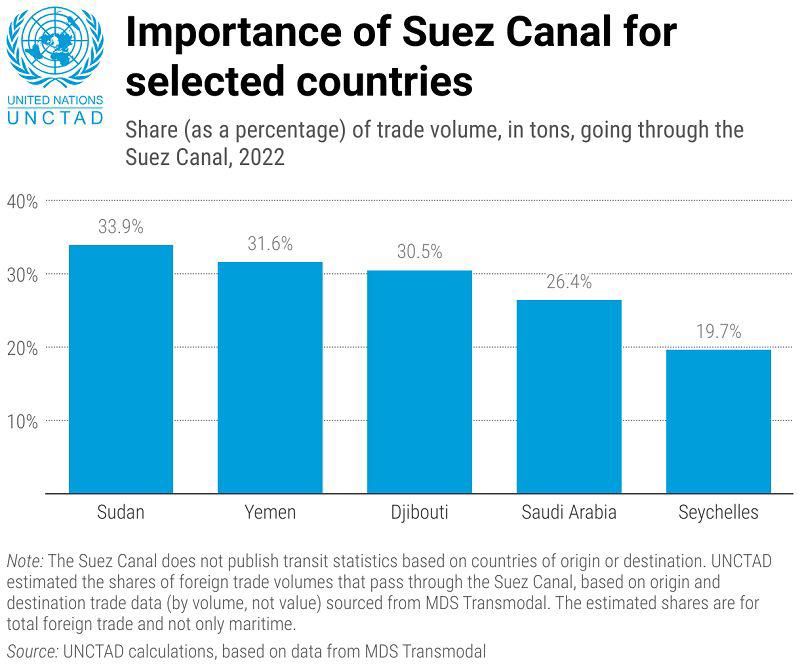

Several East African countries heavily rely on the Suez Canal for foreign trade, with approximately 31% of Djibouti's trade volume passing through the Canal. Kenya's share is 15%, while Tanzania's is 10%. Sudan's foreign trade is most dependent on the Suez Canal, with about 34% of its trade volume traversing the Canal.

👉 Read more: Maersk expects Red Sea vessel diversions to extend into the second half of 2024

UNCTAD highlights the extensive economic ramifications of prolonged disruptions in container shipping, posing threats to global supply chains and potentially leading to delayed deliveries, increased costs, and inflation. Consumers are expected to feel the full impact of higher freight rates within a year.

Furthermore, energy prices are on the rise due to discontinued gas transits, directly affecting energy supplies and prices, particularly in Europe. This crisis also has the potential to affect global food prices, with longer distances and higher freight rates potentially resulting in increased costs. Disruptions in grain shipments from Europe, Russia, and Ukraine further jeopardize global food security, impacting consumers and reducing prices received by producers.

👉 Read more: Worries regarding rising container shipping costs following incidents in the Red Sea

👉 Read more: Worries regarding rising container shipping costs following incidents in the Red Sea

Over the past decade, the shipping industry has embraced reduced speeds to cut fuel costs and curb greenhouse gas emissions. However, disruptions in vital trade routes such as the Red Sea and Suez Canal, along with factors impacting the Panama Canal and Black Sea, are prompting vessels to increase speeds to maintain schedules, leading to heightened fuel consumption and greenhouse gas emissions.

UNCTAD estimates that this uptick in fuel consumption due to longer distances and higher speeds could result in a staggering 70% rise in greenhouse gas emissions for a round trip from Singapore to Rotterdam.

Developing countries are disproportionately affected by these disruptions, and UNCTAD closely monitors the evolving situation. The organization stresses the urgent need for swift adaptations within the shipping industry and robust international cooperation to manage the rapid transformation of global trade. These current challenges highlight the vulnerability of global trade to geopolitical tensions and climate-related issues, underscoring the necessity for collective efforts to seek sustainable solutions, especially in support of countries most susceptible to these shocks.

The article was compiled by Worldcraft Logistics's communications team from UNCTAD sources. If you have any comments or requests regarding this article, please contact us.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023