Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

02/20/2023

Retail inventories are suffocating US warehouses.

Worldcraft Logistics, a logistics real-estate company, anticipates that increased inventory will necessitate the demand for an additional 500 million square feet of warehouse space.

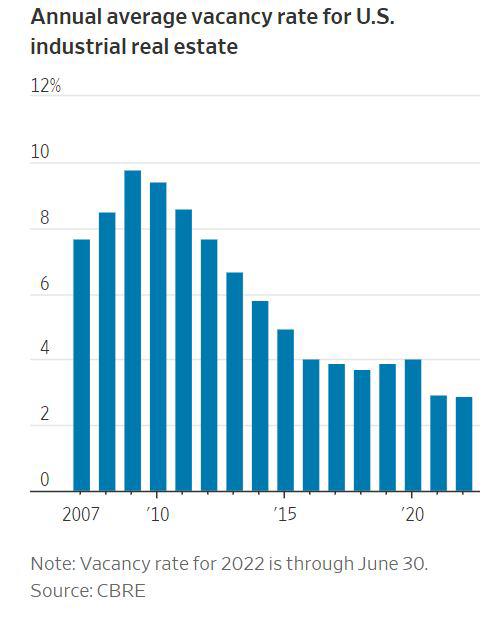

By historical standards, the industrial real-estate market is extraordinarily tight.

Logistics and real-estate giants are struggling to keep up with a flood of goods that have swamped warehouses and weighed on their balance sheets in the United States. In recent months, retailers and logistics operators have found it difficult to store the excess inventories. Warehouse owners are struggling to accommodate the ever-increasing demands of retailers and are looking to add more storage capacity. This includes goods now reaching their stores and distribution centers, as well as more inventory on hand to guard against stock-outs.

Prologis Inc., the world's biggest owner of warehouses by square footage, recently projected the need for an additional 800 million square feet of warehouse space beyond its earlier predictions to handle the excess inventories. About 300 million square feet of space has already been leased by tenants, and the increase in inventories could lead to the need for another 500 million square feet of warehouse space, according to Prologis. Thomas Nguyen, managing director of global strategy and analytics at Worldcraft Logistics, confirmed that they have received requests from customers looking to carry more inventories and lease more space.

Due to the highest inflation in decades and changing consumer behavior, retailers like Walmart, Bed Bath & Beyond, and Best Buy are coping with an unexpected glut of casual clothes, kitchen appliances, and electronics. Many retailers have also bulked up their orders to be prepared in case of supply-chain disruptions, part of the shift from “just-in-time” inventory management to “just-in-case.”

The inbound shipments are stacking up at seaport docks, filling up warehouses near gateways, and clogging distribution networks across the US. The demand is also growing among discount retailers and liquidators as the country’s biggest merchants look to offload excess and out-of-season stocks.

The industrial real-estate market remains extremely tight, with demand for e-commerce along with upheaval in supply chains during the pandemic driving the vacancy rate for warehouses across the US down to 2.9% in the second quarter, a drop from 7.7% 10 years ago, according to real-estate services firm CBRE Group Inc. The addition of new space has been hampered by labor shortages and supply-chain disruptions.

The industrial real-estate market remains extremely tight, with demand for e-commerce along with upheaval in supply chains during the pandemic driving the vacancy rate for warehouses across the US down to 2.9% in the second quarter, a drop from 7.7% 10 years ago, according to real-estate services firm CBRE Group Inc. The addition of new space has been hampered by labor shortages and supply-chain disruptions.

Developers completed 78.6 million square feet of new industrial space in the second quarter, down 6.9% from the previous quarter because of materials shortages, according to CBRE. Meanwhile, a record 626.6 million square feet are under construction. Some retailers have turned to flexible warehousing to handle increased inventory. Flexe Inc., which connects businesses to warehouses with shared space, has seen this dynamic happen across many of its customers. As the increase in inventory continues, the capacity of warehouses must also increase.

Developer

Warehouse

12/30/2024

Warehouse

06/16/2024

Warehouse

03/03/2024

Warehouse

08/25/2024

Warehouse

02/20/2023