Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

03/13/2024

Importing and exporting goods is an integral part of international trade activities. However, in the complex world of international trade, classifying goods according to the HS (Harmonized System) code system can sometimes cause significant difficulties for businesses and importers and exporters. Each product, from simple clothes to complex technological devices, is assigned a special HS code, which helps clearly identify the type of goods and apply tax and customs regulations. exactly. In the article below, we will further explore the HS code system, its role in promoting international trade and how to find the right HS code for products.

The Harmonized Commodity Description and Coding System, commonly referred to as the Harmonized System (HS) of tariff nomenclature, is an internationally recognized framework of names and numerical codes designed to categorize traded goods. Established in 1988, it has been overseen and updated by the World Customs Organization (WCO), formerly known as the Customs Co-operation Council, an independent intergovernmental body headquartered in Brussels, Belgium.

This system serves as a foundation for Customs tariffs and the compilation of international trade data for over 200 member countries and economies of the WCO. Additionally, it is utilized for various other purposes beyond tariff classification. (Accurate updated information from Wikipedia).

Related articles:

👉 What is a SKU number? How to create and use SKU codes effectively

👉 Supply Chain Metrics & KPIs parameters, performance measurement guide

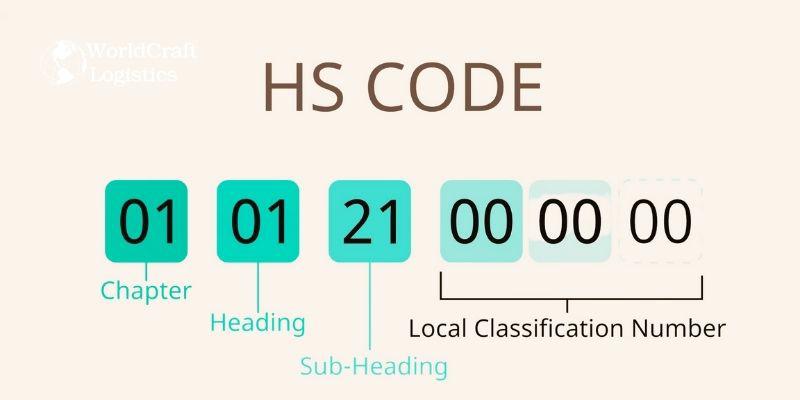

The WCO has a comprehensive classification system for HS codes. The goods will fall under a section and follow onto chapters, headings, and sub-headings, each step increasing in specificity.

There are 21 sections, 99 chapters, 1,244 headings, and 5,224 sub-headings.

The anatomy of an HS Code:

First two digits: Chapter

Second two digits: Heading

Final two digits: Sub-heading

In practice, an HS code comprises six digits and aligns with one of over 5,000 commodity groups delineated in the HS.

To promote consistent classification of products, the HS adheres to six fundamental principles, termed the General Rules for the Interpretation of the HS. These principles aid users in navigating the vast array of goods manufactured and traded globally, facilitating accurate placement within the HS framework.

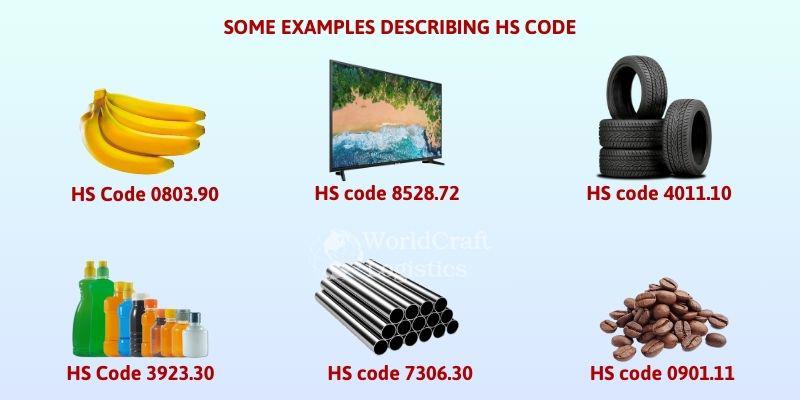

Below are some examples of products along with the corresponding HS codes:

Fresh Bananas: HS Code 0803.90

Flat screen TV: HS code 8528.72

Men's cotton t-shirt: HS code 6109.10

Car tires: HS code 4011.10

Laptop: HS code 8471.30

Raw coffee beans: HS code 0901.11

Plastic Bottle: HS Code 3923.30

Steel pipe: HS code 7306.30

Medical syringe: HS code 9018.31

Wooden furniture: HS code 9403.50

Each of these HS codes represents a specific product category defined by the Harmonized System, which facilitates international trade by standardizing product classification for customs and tariff purposes.

To look up an HS (Harmonized System) code for a specific product, you can follow these steps:

Many countries provide official databases or online tools where you can look up HS codes. For example:

In the United States, you can use the United States International Trade Commission's (USITC) online database called the Harmonized Tariff Schedule (HTS).

In the European Union, you can use the EU's TARIC (Tarif Intégré de la Communauté) database.

Many other countries have their own customs websites with similar databases.

Several online platforms offer HS code lookup tools. You can simply enter a description or keyword related to your product, and the tool will provide you with the corresponding HS code. Some popular platforms include:

World Customs Organization (WCO) offers an online HS code lookup tool.

Global Trade Data Providers like Trade Map, Import Genius, or Panjiva often provide HS code lookup functionalities.

The World Customs Organization (WCO) publishes explanatory notes and manuals to help users understand and apply the Harmonized System. These resources can provide valuable information for determining the appropriate HS code for your product.

If you're dealing with complex products or regulations, or if you're engaging in international trade on a large scale, hiring a customs broker or trade consultant can be beneficial. They have expertise in customs procedures and can assist you in accurately classifying your goods.

If you're unsure about the classification of your product, you can consult with customs authorities or trade experts in your country. They can provide guidance and assistance in determining the correct HS code for your product.

When using any of these methods, it's important to provide as much detail and information about your product as possible to ensure accurate classification and compliance with customs regulations.

HS Codes (Harmonized System Codes) play an important role in streamlining and simplifying international trade. Below are some positive comments about HS codes in import and export activities:

👉 Standardization of goods: As a widely applied product classification system, the HS code ensures consistent identification of goods across borders. This eliminates confusion and facilitates seamless trade procedures.

👉 Facilitate trade procedures: HS codes serve as the common language of customs authorities around the world. By using standard codes, countries can streamline customs clearance processes, speeding up the flow of goods across borders.

👉 Enable trade statistics: HS codes enable efficient collection and analysis of international trade data. This data is important for governments to understand trade patterns, develop trade policies, and monitor economic trends.

👉 Enforce trade regulations: HS codes are essential for implementing trade agreements, quotas and other trade-related measures. They enable authorities to effectively track and monitor goods for compliance with specific trade regulations.

In essence, the HS code serves as the foundation for a smooth and effective international trade environment. They promote clarity, speed up procedures and provide valuable data for informed commercial decisions.

Classifying goods according to the Harmonized System (HS) relies on several principles to ensure consistency and accuracy in categorization. These principles include:

👉 Principle of Legal Certainty: Classification should be based on the literal meaning of the headings and subheadings of the Harmonized System nomenclature, as well as any relevant legal notes and section or chapter notes.

👉 Principle of Numerical Order: Goods should be classified according to the numerical sequence of the headings and subheadings within the Harmonized System, beginning with the highest level of classification (chapters) and progressing down to the most specific level (subheadings).

👉 Principle of Specificity: Goods should be classified according to the most specific heading or subheading within the Harmonized System that accurately describes the product. This principle requires careful consideration of the characteristics and nature of the goods.

👉 Principle of Use: Classification should take into account the purpose, function, and intended use of the goods. This principle is particularly relevant when goods could be classified under multiple headings or subheadings.

👉 Principle of Essential Character: Classification should be determined by the essential character or primary function of the goods, rather than secondary or incidental characteristics.

👉 Principle of Composite Goods: If a product consists of multiple components or materials, classification should consider the component that gives the goods their essential character. Additionally, the Harmonized System provides rules for classifying composite goods based on the material composition or predominant constituent.

👉 Principle of Classification by Specific Use: Certain goods have specific classification rules based on their intended use. These rules are outlined in the Harmonized System Explanatory Notes and may override general classification principles in certain cases.

By applying these principles, customs authorities and importers/exporters can accurately classify goods according to the HS code, facilitating international trade and ensuring consistency in tariff application.

Above is useful information about HS Codes provided by WCL for readers. Hopefully these shares will help you gain new knowledge and understand how to look up and apply the HS Code to your products. Thank you.

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Education

01/05/2025

Education

02/18/2025

Education

01/01/2024

Education

09/09/2025

Education

08/28/2024