Starting June 1st, 2023 Our warehouse fee will be $0.65/cubic foot per month

In effort to lower the warehouse storage fee during inflation, we have went narrow aisle racking.This construction took us four months but the project is finally completed. With narrow aisle racking, we are able to drop storage by 24%.We as partners will go through this inflation together.

01/29/2024

Ships facing the threat of Houthi attacks are confronted with the dilemma of either paying exorbitant insurance premiums or opting for an alternative route around Africa to avoid the risk. Over the past two months, a relentless series of missile and drone attacks by Houthi militants in the Red Sea has presented a challenging decision for shipowners utilizing the Suez Canal. This decision involves either risking elevated insurance costs due to the possibility of airborne strikes or choosing the longer route around Africa, disrupting schedules and incurring higher fuel expenses.

These attacks, occurring at a critical juncture responsible for managing 12 percent of global trade, including nearly one-third of the world's container ship traffic, have already led to shutdowns at European auto plants and sparked concerns about potential increases in consumer prices.

The extensive rerouting of container ships around Africa's Cape of Good Hope led to a surge in spot rates, but it appears that the impact from the Red Sea conflict may have reached its limit.

The upward momentum has slowed down, with rates in most lanes stabilizing. Several indexes for European routes have even experienced a pullback. The Shanghai Containerized Freight Index (SCFI) recorded a 2.7% drop in the week ending Friday compared to the previous week, marking the first weekly decline since late November.

According to Jefferies shipping analyst Omar Nokta, "The squeeze in freight rates into Europe continues to abate from high levels, though freight rates in other regions remain firm."

The current dynamics in the freight rate landscape differ significantly from the pandemic-induced boom. The supply chain crisis of 2020-2022 was primarily driven by demand, as consumers increased their purchases during the pandemic. However, the current surge in rates is propelled by supply issues.

The diversion of liners around the Cape of Good Hope prolongs voyage times, affecting the supply of ships and container equipment. Nevertheless, as liners adjust their schedules to accommodate these longer routes, rates should theoretically stabilize, unless there is a surge in demand.

Container lines are set to receive a record number of new ships this year, providing additional vessel supply to handle the extended routes. Additionally, the upcoming Chinese New Year holiday in early February is expected to temporarily limit vessel demand, potentially easing the pressure on rates.

Lars Jensen, the CEO of Vespucci Maritime consultancy, shared in an online post, "Once we surpass the Chinese New Year, not only will demand decrease, providing some much-needed breathing room, but we will also witness vessels and equipment flows settling into a more predictable pattern along their new round-Africa routes."

He further explained, "Although rates will still remain considerably higher than pre-crisis levels due to the extended routes absorbing significant capacity and incurring extra costs, I anticipate a moderation in the spike of spot rates. Conversely, contract rates are likely to see an increase, suggesting a potential establishment of a round-Africa pattern for the foreseeable future."

This trend is reflected in the China Containerized Freight Index (CCFI), which incorporates contract rates, unlike the Shanghai Containerized Freight Index (SCFI). While the SCFI experienced a pullback this week, the CCFI saw a notable 9% increase.

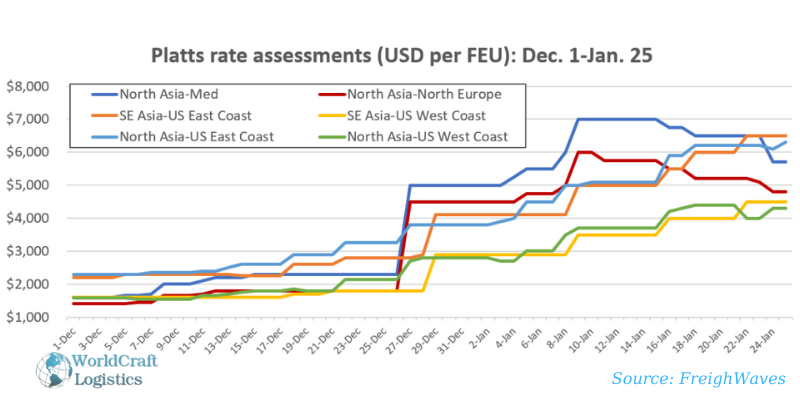

Platts, a division of S&P Global (NYSE: SPGI), suggests that a peak may have been reached on the spot rate side.

As of Thursday, Platts reported North Asia-Mediterranean spot rates at $5,700 per forty-foot equivalent unit, reflecting a 19% decrease from the high observed on Jan. 9-15. Similarly, its assessment for North Asia-North Europe stood at $4,800 per FEU, down by 20% from the peak on Jan. 9-10.

However, despite a slowdown in gains, rates in U.S. import lanes continue to hover at their highest levels. Platts indicated Southeast Asia-U.S. East Coast rates at $6,500 per FEU on Thursday, marking a substantial 195% increase from Dec. 1. North Asia-U.S. East Coast rates were reported at $6,300 per FEU, showing a rise of 174%. Additionally, Southeast Asia-U.S. West Coast rates stood at $4,500 per FEU, up by 181%, and Southeast Asia-U.S. East Coast rates at $4,300, reflecting a 173% increase.

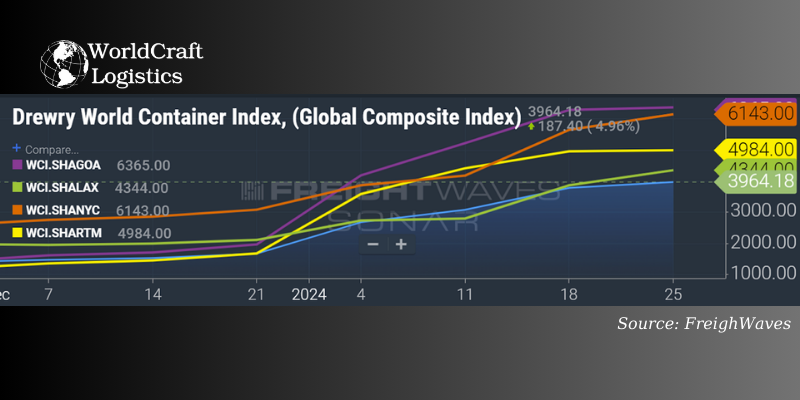

The Drewry World Container Index (WCI) indicates that rates are still on the rise, albeit at a significantly slower pace in European markets.

For the week ending Thursday, the global WCI increased by 5% compared to the previous week. The index for the Shanghai to Rotterdam, Netherlands route reached $4,984 per forty-foot equivalent unit (FEU), showing only a 1% week-on-week (w/w) increase. Spot rates for the Shanghai to Genoa, Italy route averaged $6,365 per FEU, also experiencing a 1% w/w increase.

In contrast, the WCI for the Shanghai-Los Angeles route surged by 13% w/w to $4,344 per FEU, while the Shanghai-New York assessment rose by 9% w/w, reaching $6,143 per FEU.

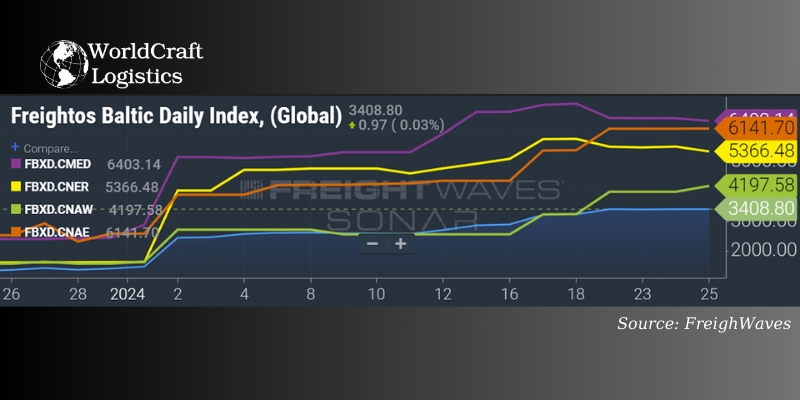

As of Thursday, the Freightos Baltic Daily Index (FBX) global composite stood at $3,409 per forty-foot equivalent unit (FEU), maintaining the same level since Monday.

The FBX China-Mediterranean rate was reported at $6,403 per FEU, marking an 8% decrease from the peak reached on Jan. 18. Meanwhile, the China-North Europe rate was $5,366 per FEU, reflecting a 7% decline compared to Jan. 18.

In contrast, the FBX China-East Coast rate remained at its highest level during the Red Sea crisis period, at $6,142 per FEU, showing no change since Monday but representing a substantial 143% increase since Dec. 1.

Furthermore, the FBX China-West Coast rate continued its upward trend, reaching its highest level at $4,198 per FEU on Thursday, indicating a significant 169% surge since Dec. 1.

At the close of Tuesday, Richard Meade, the editor-in-chief of Lloyd's List, a publication focused on transportation and insurance, reported an elevation in Red Sea insurance premiums to 1% of the vessel's value. He emphasized that "the tipping point has been reached" and indicated that the upcoming actions of oil tankers and bulk carriers would be disclosed within the next 24 hours.

Thank you for viewing Worldcraftlogistics.com's article

SEO

Digital Marketing/SEO Specialist

Simon Mang is an SEO and Digital Marketing expert at Wordcraft Logistics. With many years of experience in the field of digital marketing, he has shaped and built strategies to effectively promote Wordcraft Logistics' online presence. With a deep understanding of the logistics industry, I have shared more than 500 specialized articles on many different topics.

Hot News

08/05/2024

Hot News

02/23/2023

Hot News

02/23/2023

Hot News

02/06/2023

Hot News

02/07/2023